Minimum Wage in Malta 2026 - Per Hour | Per Week | Per Month

Updated at Feb 03, 2026 | by Admin

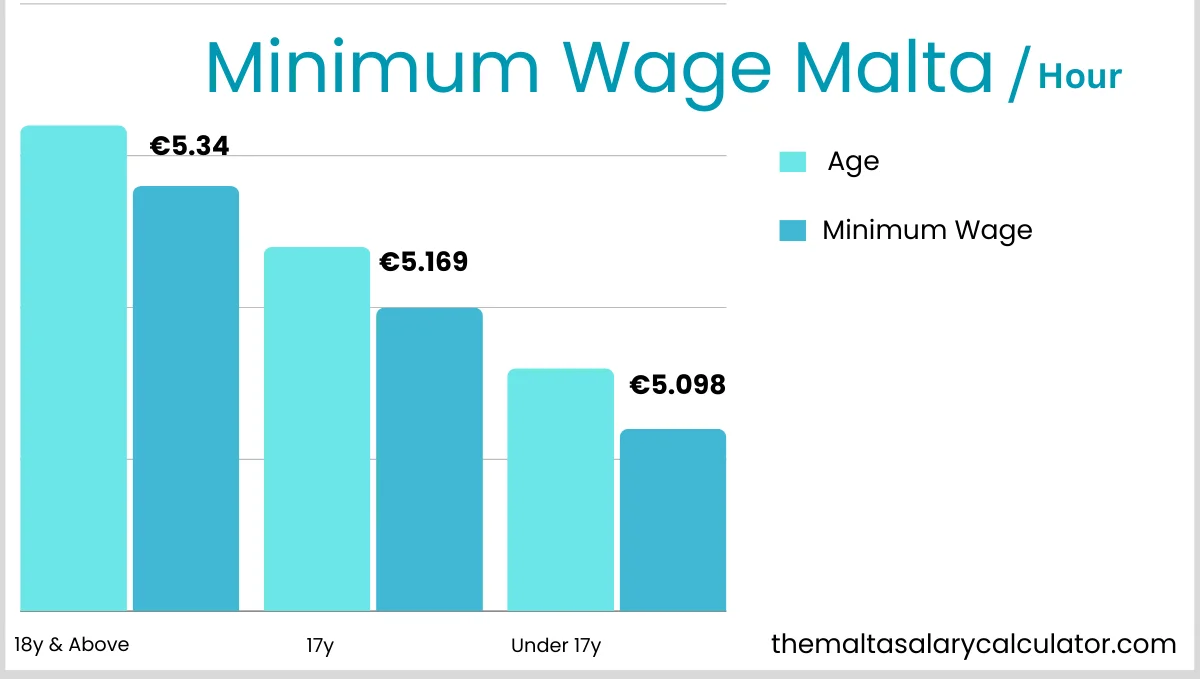

Hourly Minimum Wages

- Full time workers who are 18 years old or above is €5.73 per hour.

- For 17 years old is €5.56 per hour.

- For under 17 years is €5.49 per hour.

Weekly Minimum Wages

- Full time workers who are 18 years old or above is €229.44* per week.

- Who are 17 years old is €222.66 per week.

- Who are aged below 17 years is €219.82 per week.

Monthly Minimum Wages

- For full time workers who are 18 years old or above is €917.76 per month.

- For those who are 17 years old is €890.64 per month.

- Who are aged below 17 years is €879.28 per month.

Minimum Wage from 2016 to 2026

Part Time Employees

Part time employees are eligible to be paid the same minimum hourly rate of €5.73. However, there can be two cases to calculate the exact minimum wage for a part time employee.

1- Where WRO is Applicable

Part time employees are paid the same hourly rate as a comparable full time employee gets according to WRO for their industry. WRO stands for wage regulation order. In Malta, government issues WROs for specific industries like Agriculture, Construction, Food, health and more. These WROs define minimum wage rates, working hours and other employment conditions. You can find more information about WROs here.

2- Where WRO is not Applicable

In case where WRO is not applicable, the hourly rate for part time employees is calculated through dividing national weekly minimum wage of a comparable full time employee by 40. This will give the hourly rate of a comparable full time employee, the part time employees will be paid the same hourly rate according the number of hours worked.

Minimum Wage in Malta For International Students

International students can make minimum 5 euros per hour in Malta. There can also be better opportunities, where they can make more depending upon their level of skills.

It is important to note that job opportunities for international students can be limited. Most common jobs for students can be found in hospitality and tourism sectors.

Number of Working Hours For Students

- International students are allowed to work 20 hours per week during their academic period.

- During semester/summer breaks, students are allowed to work for 40 hours per week.

Purpose of Minimum Wage

There are several reasons for a country to set a minimum wage:

- Protect workers from being exploited by their employers.

- Encourage fair pay for the work done by the workers.

- Avoid any inequality in pay for employees working in the same role.

- To eliminate gender-based pay inequality.

- To help the working class fight poverty and fulfill their basic needs of food, shelter and clothing.

Is Minimum Wage Taxable in Malta?

In most cases, the minimum wage is not taxable in Malta, because the annual income of a full-time minimum wage earner is below the taxable income threshold. Malta's tax system is based on annual income brackets, and taxation only starts once your income exceeds the first taxable threshold of €12,000.

A full-time employee earning minimum wage in Malta makes €11,013.12 per year which is less than the minimum taxable income. So, employees earning only minimum wage do not pay income tax.

You can learn more about Malta's tax brackets in our guide on Maltese tax rates.

Minimum wage can become taxable if:

- You work overtime and your annual income increases.

- You earn income from a second job.

- You receive allowances or benefits that increase your taxable income.

Why minimum wage is usually tax exempt:

- The first tax bracket starts above the annual minimum wage.

- Malta's system protects low-income workers through a 0% tax band.

- Low-income earners may also benefit from tax refunds and tax credits.

There are 40 working hours in a week for a full-time job.

Yes, even international students can work 20 hours a week in Malta.

No, Saturday is not a working in Malta for Government institutions.