Table of Contents

Tax Identification Number (TIN) in Malta

Updated at April 30, 2025 | by Admin

Maltese nationals can use their Identify Card Number as their Tax Identification Number (TIN) but non-Maltese nationals need to apply for their Tax Identification Number (TIN) at the Inland Revenue Department. Upon application, non-Maltese citizens will get a 9 digits TIN within two days. In some cases, their residence card number is also used as their TIN.

Application Process

Maltese nationals and foreigners from EU nations who have already applied for a social security number do not need to apply for a TIN. But foreigners from non-EU nations need to apply for a TIN through this e-form https://mtca.gov.mt/personal-tax/individual/expatriatesregistrationform

In the application form, applicants need to add their personal information along with their passport number, Maltese ID number if available. Moreover, they will have to provide your tax details like date of arrival in Malta, date of employment and the purpose of registration.

If the applicant is married and both spouses are resident in Malta then the applicant will have to provide details about their spouse. As well as their Maltese ID number, social security number, a photo of the marriage certificate and a photo of the declaration of residence signed by the other spouse.

After submitting the application form, applicants are likely to get the tax identification numbers within the next 8 working days.

TIN Structure

| Format | Explanation | Comment |

|---|---|---|

|

(0000)999L |

8 characters: - 7 digits - 1 letter (M, G, A, P, L, H, B, Z) |

Individuals who are Maltese nationals Note 1: the first 4 digits may be omitted when they are 0 (zero). Note 2: in the case of IT processing, the length of this TIN must always be 8 characters; the first 0 (zero) must thus always be recorded |

999999999 |

9 digits |

Individuals who are not Maltese nationals |

Where to find TINs?

TINs are reported on the following official documents of identification:

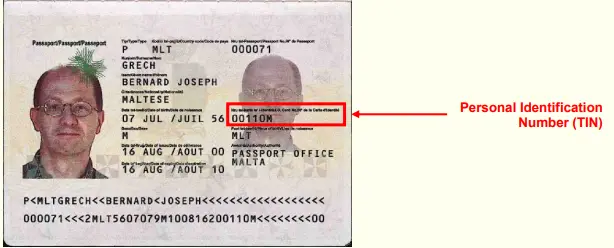

Passport

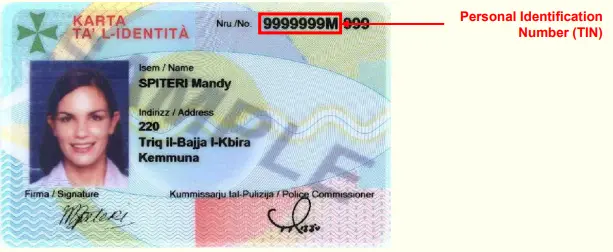

Identity card (Karta ta’ l-Identita’

Uses of TIN in Malta

TIN is used in various activities by individuals and businesses like filing tax returns, paying income taxes and claiming tax refunds. It is also used for financial transactions like opening a bank account, applying for loans and even investing in the stock market.

TIN is also required to register a new business with the Malta Business Registry (MBR). Afterwards TIN is required to apply for a VAT number and to report employee salaries and comply with payroll tax loads. It is also used in property transactions and cross-border economic activities.

Common Issues and How to Resolve Them

The Maltese authorities make sure that the whole tax system works smoothly. Still there are cases being reported where people face issues related to their TIN.

The most common issue reported is incorrect TIN format. If you find your TIN has an incorrect format, you can call at 153 which is the number for Malta’s freephone helpline, servizz. Once the call is connected, you need to dial 06 to get information about tax. Then you will be referred to a relevant person whom you can tell about your issues.

Office timings for servizz.gov.mt are:

- Monday to Friday: 08:00 AM to 04:00 PM

- Wednesday (Extended Hours): 08:00 AM to 07:00 PM

Make sure to call them during their working hours. You can also send an email at [email protected] along with your residence ID number and your date of birth.